CHEQ Acquires Deduce, Expanding Go-To-Market Security Platform

Pairing AI-driven, context-specific threat detection with identity intelligence to protect a wider range of attack vectors across the customer journey than any other cybersecurity platform.

Pairing AI-driven, context-specific threat detection with identity intelligence to protect a wider range of attack vectors across the customer journey than any other cybersecurity platform.

Today, we’re excited to announce our acquisition of Deduce, the only patented technology platform designed to prevent AI-generated identity fraud. Together, our combined offering enables and protects the entire digital journey, keeping it secure, compliant, and friction-free for human, agent-enabled, and machine customers – the foundation for enterprise go-to-market effectiveness in today’s increasingly AI-fueled economy.

The first fully compliant and secure identity graph that pairs real-time identity and longitudinal data with real-time traffic insights and decisioning, Deduce’s proprietary technology will integrate with CHEQ’s innovative go-to-market security platform, which today protects the business-critical digital interactions of the world’s most admired brands including Angi, Zscaler, S&P Global, and The George Washington University. This is the company’s third acquisition and is part of an aggressive M&A strategy designed to strengthen the end-to-end capabilities of the CHEQ platform by identifying the root source of malicious and fraudulent digital activity and preventing it from infiltrating clients’ first- and third-party technology ecosystems.

“We’re thrilled to welcome Deduce to the CHEQ family,” said Guy Tytunovich, co-founder and CEO of CHEQ. “By merging Deduce’s cutting-edge identity fraud prevention with CHEQ’s context-specific go-to-market security platform, we are the only cybersecurity solution equipped to protect the entire customer journey now and through every digital evolution to come. In the age of AI, where agents and machines emerge as key constituents in the customer journey, CHEQ remains fully dedicated to our mission of protecting businesses from emerging threats and sophisticated fraud while never jeopardizing revenue opportunities, disrupting the customer experience, or compromising security.”

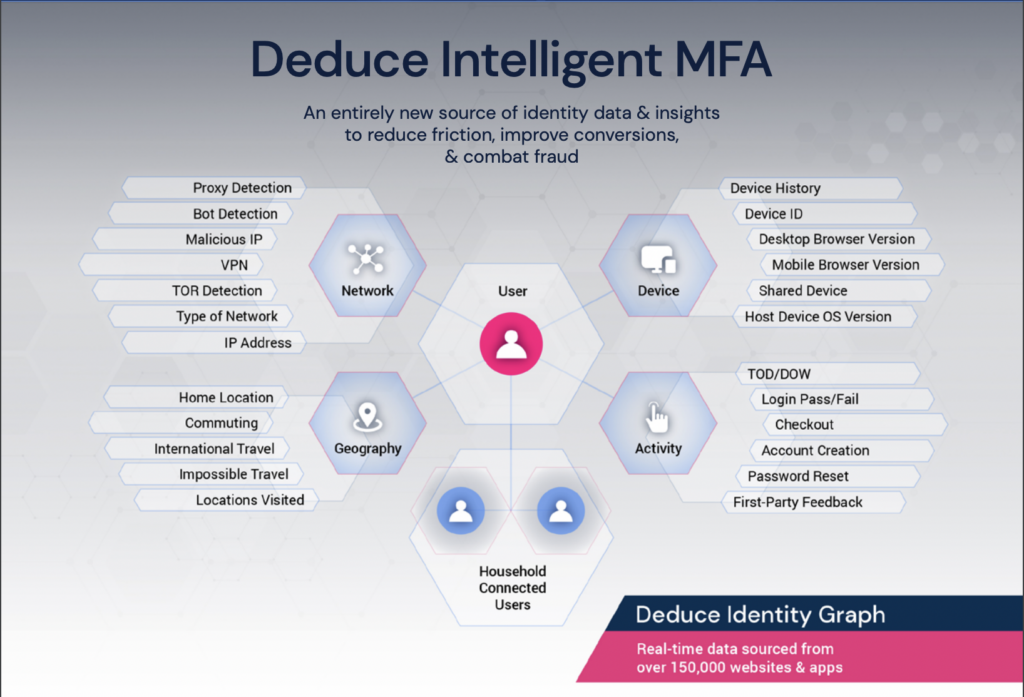

Deduce’s Identity Graph, the largest independent identity graph for cyber risk and fraud, continuously captures data from over 185 million weekly active users engaged in 1.5 billion daily events. Its patented technology provides context for fraud detection. By enabling real-time, multi-contextual forensics to safeguard sensitive accounts, the technology prevents “SuperSynthetic” identities — AI-generated personas with convincing documents, biometrics, and credit histories — from opening new accounts and flags those already embedded among existing customers to prevent account takeover attempts and protect user credentials from unauthorized access. The platform achieves 99.5% accuracy in identity assessments, empowering organizations to protect user credentials and streamline the customer experience.

CHEQ is a unified platform engineered to monitor, remediate and protect against all potential attack vectors that threaten customers’ go-to-market operations. This includes human, agent, and machine-driven risks that can jeopardize business continuity, brand reputation, customer data security, privacy compliance, and resource allocation, all of which are only proliferating in a world that is increasingly AI-driven.

“The rapid adoption of AI technology has introduced complex challenges, including the rise of fake identities capable of subverting traditional fraud solutions,” said Ari Jacoby, co-founder and CEO of Deduce. “By integrating trust scores with context-specific detection and defense, we are addressing the critical question: ‘Is this a real person, and are they who they claim to be?’ Together with CHEQ, we’re paving the way for a more secure and friction-free customer experience for the most recognized brands and regulated businesses in the world.”

“With the proliferation of AI, requirements for businesses managing identities and their access to sensitive and regulated information will grow,” said Robert Panasiuk, co-founder and CTO of Deduce. “With a team as dynamic and sophisticated as CHEQ’s, the agility and strength of Deduce’s identity solution will continue to set the standard in identity fraud prevention.”

Discover the benefits of CHEQ + Deduce: request more information.